The Development Trend of Intermediates Industry

Industry Perspective

This report mainly provides an in-depth analysis of the intermediates industry. As an important field of fine chemical industry, intermediates industry has huge development space. This report starts from the perspective of industry chain transfer and competitive advantage, and explores the future development trend of intermediates industry in China with reference to the development history of leading intermediates enterprises.

The global industrial division of labor is gradually clear, and China has outstanding advantages in developing fine chemicals. International industrial transfer continues, and for the chemical industry, the type of industrial transfer is upgraded to differentiated fine chemical products. Undertake the industrial transfer of the fine chemical industry, China's labor cost advantage over India and other countries still exists. The complete industrial chain layout as well as supporting facilities will be China's unique development advantage, which is difficult to surpass, so China's overall competitive advantage still exists.

China intermediates industry continues to develop and enters a new stage of development. As an important branch of fine chemical industry, intermediate industry continues to develop rapidly under the background of industrial transfer and superimposed on China's demand. China's environmental protection requirements are tightening, resources are tilted to high value-added industries, and with the rise of environmental protection costs, leading chemical companies will gain more competitive advantages. Therefore, the leading companies in the fine chemical industry will benefit centrally.

R&D is of great importance to the intermediate industry, and the current Chinese chemical industry generally attaches less importance to R&D. In the environment of rising technical requirements, efficient R&D-oriented enterprises with strong R&D strength will stand out.

The demand for pesticides and pharmaceutical intermediates is growing steadily and has room for growth. Pesticides and pharmaceutical intermediates are still In the growth period, the industry itself has strong room for growth. For the customized intermediates with strong profitability, the downstream patented drugs will face a large number of patent expiration in the next few years, and the generic drugs will get a significant increase in space. In the short term, intermediates manufacturers will still enjoy the explosive growth of demand, upgrade from CMO mode to CDMO mode, and enjoy the profitability improvement of product release. In the long term, with their technological advantages, they will extend downstream of the industry chain and carry out integrated layout, which will further enhance the profitability of enterprises.

Recommendations

In the context of the continuation of the trend of industrial transfer, the continued growth of downstream industries and the tightening of environmental protection in China, the industry has passed the rough and rapid development period and will pay more attention to the quality of development and enter a new stage of prosperity for the leaders. The leading pesticide and pharmaceutical intermediate companies with strong R&D strength and industrial chain extension layout, which can develop to CDMO mode through excellent R&D technology advantage, will occupy a dominant position in the market. We recommend choosing intermediates with perfect environmental protection system, strong R&D strength and industry chain extension opportunities Leading enterprises.

Research Logic

China's chemical industry has jumped to the first place in the world in terms of sales volume. Under the general trend of increasing the rate of fine chemicals, the intermediate industry, as an important field of fine chemicals, has huge development space. This paper mainly answers several key questions of intermediate industry in the development process from the perspective of industry chain transfer and competitive advantage.

·In the past ten years, international industrial transfer has driven the rapid development of China's pesticide and pharmaceutical intermediates industry, does the advantage of China to undertake industrial transfer still exist today?

·After the rapid development of intermediates in the past, what kind of development stage will the intermediates industry enter in the future?

·The downstream pesticide and pharmaceutical industries are facing the "patent cliff", what kind of impact does it have on the custom intermediate enterprises?

The advantages of developing fine chemical industry in China are outstanding: through the research and analysis of intermediate industry, we believe that the international industrial transfer is still going on, and for the chemical industry, the type of industrial transfer is upgrading to differentiated fine chemical products. Undertaking the industrial transfer of fine chemical industry, China's labor cost advantage over India and other countries still exists, and China's complete industrial chain layout and supporting facilities will be China's unique development advantage, which is difficult to surpass, so the overall competitive advantage still exists.

China intermediate industry will enter a new stage of development of leading prosperity in the future after experiencing the rapid development of rough and loose in the past. On the one hand, China's environmental protection requirements are tightening and resources are tilted to high value-added industries. With the increase of environmental protection costs, leading chemical companies will gain more competitive advantages. On the other hand, the current Chinese chemical industry generally attaches less importance to R&D. In the environment of rising technology requirements, efficient R&D-oriented companies with strong R&D strength will stand out.

Under the background of patent cliff, there are opportunities for CDMO mode and industry chain extension: pesticide and pharmaceutical intermediates are still in the growth period, and the industry itself has strong growth space. For the custom intermediates with strong profitability, their downstream patented drugs will face a large number of patent expiration in the next few years, and the generic drugs will get a significant increase in space. Intermediates manufacturers will still enjoy the explosive growth of demand in the short term. In the short term, intermediate manufacturers will still enjoy the explosive growth of demand, upgrade from CMO mode to CDMO mode, and enjoy the profitability improvement of product release. In the long term, with their technological advantages, they will extend downstream in the industry chain and carry out integrated layout, and their profitability will be further enhanced.

1. The global industrial division of labor is gradually clear, and China has outstanding advantages in developing fine chemicals

1.1 Global industrial division of labor is gradually clear, and China is gradually taking up industrial transfer

Global economy becomes integrated and international industrial transfer continues. With the deepening of global economic integration, four large-scale international industrial transfers have taken place, and now the outsourcing of R&D and production has become an important part of international industrial transfer. Among them, before 1980, it was manifested as a gradient transfer from the first country (region) to the second country (region). After 1980, the transfer of labor-, capital- and technology-intensive industries was carried out within multinational corporations, and the mode of transfer was extended from international trade and investment to production outsourcing and merger and reorganization, and the field of industrial transfer was extended to service industry. Along with the transfer of industries, a clear pattern of industrial division of labor has gradually formed globally. From the perspective of the global resource allocation process, the adjustment and upgrading of industrial structure reflect the comparative advantage that the country has in the global economy.

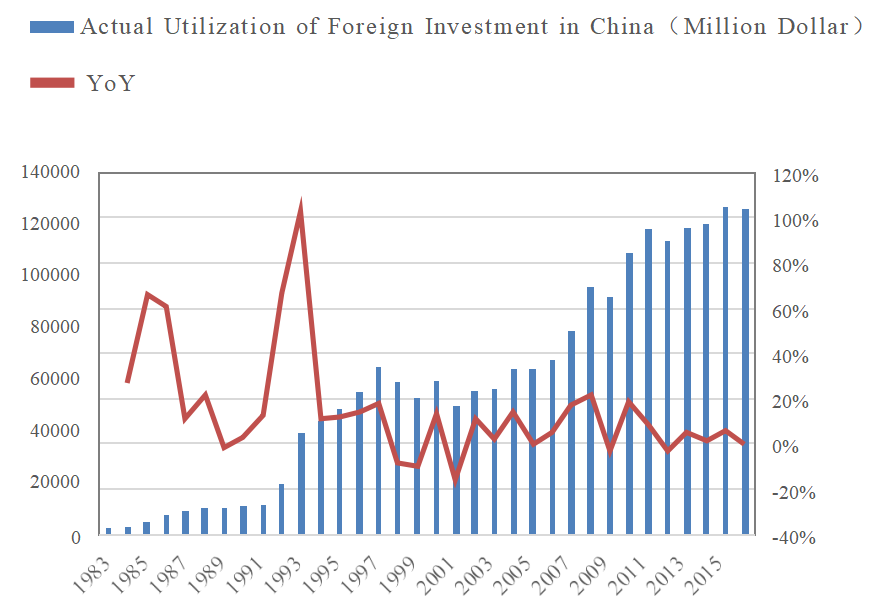

Since the 1980s, China has been gradually taking over industrial transfer. In terms of actual foreign investment utilized in China, the actual amount of foreign investment utilized in China was US$2.26 billion in 1983, and with the deepening of reform and opening up, a period of rapid growth of industrial transfer was initiated. From the 1980s to the present, there are two major trends of industrial transfer from other countries and regions around the world to China: first, the scale of industrial transfer is getting larger and larger, and the increasing amount of actual foreign investment utilized in China each year reflects to a certain extent the increasing scale of industrial transfer, and second, the industries transferred are constantly upgraded.

Figure 1: The scale of industrial transfer undertaken by China is increasing

1.2 The development of fine chemical industry, China's advantages are still outstanding

Unlike bulk chemical products, the driving force for the transfer of the fine chemical industry is above cost, and there are also high requirements for technical strength and the degree of industry chain support. The fine chemical production process has long processes, many unit reactions, complex raw materials, strict intermediate process control requirements, and requires highly specialized knowledge and equipment for production. In particular, fine chemical products with high added value require higher technical content. At the same time, because fine chemical products are generally in the middle and lower reaches of the industrial chain, they have high requirements for the completeness of the industrial chain.

China's overall competitive advantage still exists in taking over the industrial transfer: in the past, most of China's industrial development was based on the advantage of labor cost, at the expense of the environment and brutal development. However, today, China's overall external environment has put forward new requirements for industrial development, and under the high pressure of environmental protection to improve labor productivity, China's labor costs still have a relative advantage. At the same time, after years of development, China's industrial chain is complete, and its advantages in terms of supporting facilities and transportation are still obvious, so it can be said that China's competitiveness in taking over industrial transfer still exists.

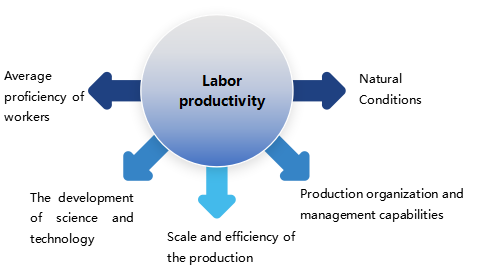

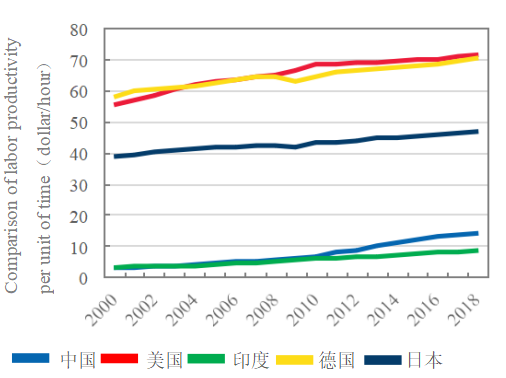

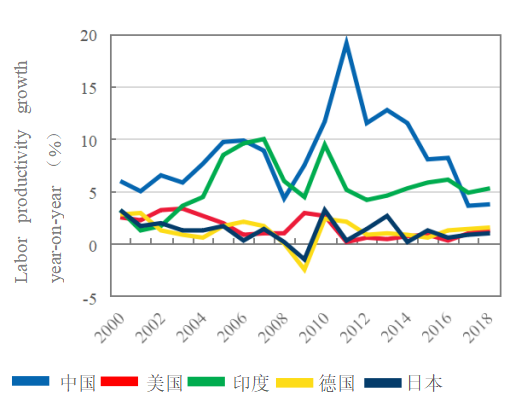

China's current comprehensive production technology level still has obvious advantages over India. According to the economic theory, labor productivity is the result of multiple factors in production. Although China still has a large gap with developed countries, China's comprehensive production level still has a clear advantage over India, the main competitor in industrial transfer. According to the conference board's Global Economic Data Base, China's overall production level in 2000 was still significantly higher than that of India, a major industrial shift competitor. According to the conference board Global Economic Data Base, labor productivity in China was $3.19/hour per person in 2000, compared to $3.34/hour in India in the same year. China's labor productivity was $3.19/hour in 2000, compared to $3.34/hour in India in the same year, and is currently $13.98/hour, which is lower than the U.S. rate of $71.69. China's current labor productivity of $13.98/hour is lower than the U.S. rate of $71.69, but significantly higher than India's rate of $8.79/hour. China has a significant advantage over India in terms of its current overall production technology level.

Figure 2: Labor productivity depends on various economic and technical factors in production

Figure 3: China has an advantage over India in terms of productivity per unit time of labor

Figure 4: China leads the world in year-on-year growth in productivity per unit of time worked

China's labor cost advantage over India still exists. Although China's labor costs (represented by average wages) have been higher than India's overall in recent years, China's unit labor cost advantage is still increasing when translated into real costs. Assuming a unit labor cost figure of 100 for both countries in 1990, the relative unit labor cost in China is 301 compared to 342 in India by 2017. That is, from 1990 to the present, especially after 2010, China's unit labor cost advantage over India has increased instead.

In terms of the ratio of labor costs to operating income of fine chemical enterprises, China's cost advantage still exists. According to the statistical results, although the ratio of Chinese fine chemical enterprises increased from 2% in 2011 to 5% in 2016, the overall ratio is still lower than that of India and European countries, and China's labor costs still have a relative advantage.

Figure 5: China has an advantage over India in terms of unit labor costs

C

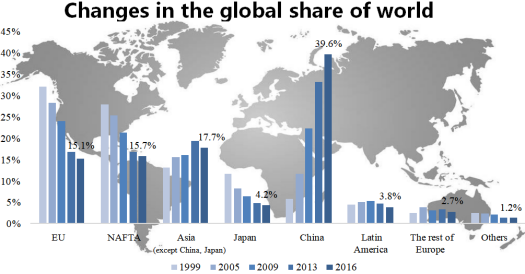

China's chemical production is growing at a fast pace, and it is difficult to surpass the advantages of industrial chain support. Since the reform and opening up, driven by China's demand, China's chemical industry has been developing by leaps and bounds as it has taken over part of the industrial transfer while continuously improving its own technological strength. Since the development of the chemical industry, China has a complete chemical industry chain, and the output of oil refining, polyester (PTA), titanium dioxide, organosilicon, dyestuff and other products are in the first place in the world. As of 2016, China's chemical product sales reached 133.1 billion euros, accounting for about 40% of the total, reaching the first place in the world, far ahead of the United States and Germany, which are in the second and third places. In the environment of clear international industrial division of labor, China's complete industrial chain layout and supporting facilities will be China's unique development advantage, which is difficult to surpass.

Figure 7: In terms of sales, China is already the world's number one chemical producer

2. China's intermediates industry continues to develop, a new stage of new opportunities

2.1 Intermediates as an important field of fine chemicals, the industry continues to develop

Intermediates are a very important type of fine chemical products, in essence, a class of "semi-finished products", and the downstream industries involved are mainly concentrated in pharmaceuticals, pesticides, dyestuffs and so on. According to statistics, in 2014, the global fine chemical market, pharmaceuticals and their intermediates, pesticides and their intermediates are the top two sub-sectors of the fine chemical industry, accounting for 69% and 10% respectively.

Figure 8: Pesticides, pharmaceuticals and their intermediates are an important part of the global fine chemical industry

Intermediates include general-purpose and customized products, and various business models of CRO and CM O/CDMO coexist. Relatively speaking, the customized products of intermediates have higher gross profit margin because of the higher process and standard required. The cooperation will be relatively stable and the sales cost is less once the long-term cooperation relationship is reached with customers. According to the different stages of outsourcing services, the customization business model of intermediates can be generally divided into CRO (contract research and development outsourcing) and CMO (contract manufacturing outsourcing).

For the reason of cost control and efficiency improvement, the simple production outsourcing service can no longer meet the needs of enterprises, so CDMO mode (production R&D outsourcing) has emerged, CDMO requires custom manufacturing enterprises to participate in the customer's R&D process, provide process improvement or optimization for customers, realize high-quality scale production, reduce production cost, and have higher profit margin compared with CMO mode. CDMO mode has benefited from the general trend of industrial transfer in recent years, and the industry has entered into a period of rapid development.

Outsourcing the production of intermediates is a major trend and an important form of industrial transfer. In recent years, as the R&D cost of new drugs rises, the number of new patented drugs decreases and the competition for generic drugs becomes increasingly fierce, the redistribution of labor and outsourcing of production in the industry chain has become a major trend. In order to reduce production costs, improve production efficiency, and reduce the risk of profitability, the manufacturers of pesticides, pharmaceuticals, and dyestuffs have been able to outsource one or more steps of their R&D and production. In order to reduce production costs, improve production efficiency, and reduce the risk of profitability, the trend is for pesticide, pharmaceutical, and dye manufacturers to contract one or more steps of their R&D and production processes to manufacturers with cost and technical advantages. If outsourcing is used, the development and production cycle can be shortened by 25% and production costs can be reduced by 30-50%, while improving efficiency and quality and reducing risks. China has become the first choice to undertake outsourced production in developed countries by virtue of its well-developed industrial chain and more mature and advanced production technology compared to other developing countries.

2.2 Pesticide, pharmaceutical and dye intermediates industry get good development foundation

With the overlapping of industrial transfer and China's demand, agricultural intermediates have gained sufficient space for development.

·The first stage: 1990s to early 21st century

At the beginning of the 21st century, China's pesticide industry system took shape, and the pesticide intermediates produced in China could basically meet the needs of pesticide industry, but some high-end intermediates still need to be imported, and the annual import amount of pesticide intermediates is about 100 million US dollars.

·The second stage: 2006 to 2014

With lower production cost, more complete industrial support and more advanced technology, China's pesticide intermediates industry has undertaken the industrial transfer of pesticide intermediates industry from developed countries, which has rapidly boosted the growth of China's pesticide intermediates and raw drug industry.

·The third stage: from 2015 to the present

Since 2014, due to the weakening demand of global pesticide industry, overseas pesticide giants entered the stage of de-stocking. China's pesticide intermediates production and output value growth rate declined significantly. In addition, after 2015, the high pressure of environmental protection forced a large number of non-standard small and medium-sized enterprises to stop production, and the industry said goodbye to the rapid development of the rough and loose stage. In the future, the intermediate industry will show the process of high-quality development and prosperity of leading enterprises.

In 2011, China produced 3 million tons of pesticide intermediates, and in 2014, it reached 4.7 million tons, with a compound growth rate of 16%. 2015 onwards, China's pesticide intermediates industry grew at a lower rate due to the downturn of the downstream pesticide industry and inventory removal by overseas leaders, and the growth rate dropped to 4.04% and 0.41% in 2015 and 2016 respectively. In 2017, the overseas pesticide giants ushered in the inventory replenishment cycle, boosting the demand for intermediates, and the growth rate picked up.

Figure 9: China's growing production of pesticide intermediates

CRO, CMO/CDMO multiple models drive the rapid development of pharmaceutical intermediates. China's pharmaceutical intermediates industry started to develop highly in 2000, developed countries pharmaceutical companies are more and more focus on strengthening their core competitiveness, namely product development and market development, and accelerating the synthesis of intermediates and API to lower cost developing countries, such as China, India, etc. Meanwhile, the export restrictions are also greatly weakened. China's pharmaceutical intermediates industry has been given excellent development opportunities. At present, China's pharmaceutical intermediates industry is one of the largest branches of the fine chemical industry.

The global pharmaceutical intermediate industry is developing at a high speed and the industry continues to shift to China. The cost of leading companies is rising and the proportion of outsourcing is still increasing. The global pharmaceutical outsourcing market maintains a high growth rate of over 10%, and in search of more efficient and low-cost production methods, pharmaceutical companies continue to increase CMO /CDMO outsourcing business in the future. According to the forecast of Southern Institute, the global CMO/CDMO market size is expected to exceed USD102.5 billion in 2021, with a CAGR of about 12.73% from 2017 to 2021. On top of that, China's industry intermediates development growth rate is 5%-10% higher than the global development growth rate, so it can be said that the pharmaceutical intermediates industry is continuing to shift to China, and there is huge space for the development of pharmaceutical intermediates in China.

China has become the largest producer of dyestuff intermediates and the industry has entered a mature stage. Since the 1970s, China's dyestuff intermediates industry began to take off, and in the 1980s, the rapid development of China's textile industry and the gradual shift of global dyestuff production to Asia significantly boosted the rapid development of China's dyestuff intermediates industry, and by the 1990s, China had become the world's largest producer of dyestuff intermediates. In recent years, China's dyestuff industry has made great progress, and the production volume of dyestuff has ranked first in the world for many years. The rapid development of dyestuff industry depends on the rapid growth of dyestuff intermediates, especially the export demand and market competition have promoted the progress of production technology and quality as well as the development of varieties and output of intermediates manufacturers.

Environmental protection requirements have increased the industry influence of large enterprises and profitability levels have recovered. Unlike pesticide and pharmaceutical intermediates, dye intermediates basically only have generic products, typical products such as H acid, para-ester, reductant, etc. In the past, dyestuff intermediates had a single product and fierce competition, and the phenomenon of price reduction and competition for sales was serious. Nowadays, under the high pressure of environmental protection, the capacity of small and medium-sized enterprises is affected, and the influence of large enterprises

The force of the increase, profitability level has recovered.

2.3 environmental protection requirements to enhance, the leading enterprises in the fine chemical industry will focus on benefiting

China's environmental requirements are tightening, high value-added industries to get more layout resources. China's current environmental protection trend can be summarized as three points: 1. environmental protection routine, strict, the future of environmental protection tend to tighten the general trend will not change, the development of green chemical road is firm; 2. enterprises into the park, standardized, the cost has increased significantly; 3. land is difficult, new project approval is difficult, the traditional project put into production no way. We believe that in the face of the ever-increasing

We believe that in the face of the increasing pressure of environmental protection policies, the way out for enterprises is to improve the added value of products and industrial integration. In other words, with increased costs and insufficient space to plan new plants, the source of future profit growth will either be R&D-driven to enhance the added value of products or through mergers and acquisitions to build an industrial platform.

Leading chemical companies will gain more competitive advantage as environmental costs rise. According to the American Chemistry Council, EH&S costs (environmental protection and employee health and safety costs) for the U.S. basic and fine chemical industries are about $14.3 billion, and for a typical company, EH&S accounts for about 5% of operating revenue. As China's environmental requirements increase, Chinese chemical companies will also face higher environmental costs in the future. Under the high pressure of environmental protection, it is difficult for small companies to bear high environmental expenses, and often only large companies have enough capital and technical power to complete environmental protection standards, and leading companies will gain a higher competitive advantage.

2.4 Technology requirements continue to improve, efficient R & D enterprises will stand out

R&D is of great significance to the intermediate industry. At present, China's intermediates industry can meet the needs of most industries of downstream pesticides, pharmaceuticals and dyestuffs, but still a small part of the demand depends on imports, intermediates enterprises will focus on developing intermediates that China can not yet produce in the future. And the overseas intermediates enterprises pay high attention to technology research and development and get good returns. Increase investment in R&D and strengthen independent innovation have more independent innovation intermediates, including compound, process route and process condition innovation, can get independent intellectual property rights and more right to speak, at the same time, enterprise gross margin has more room for improvement.

3. Intermediates industry has huge space and multiple development opportunities

Pesticide and pharmaceutical intermediates are still in the growth period, and the industry itself has strong growth space. Among them, custom intermediates with strong profitability will face a large number of patent expiration in the next few years, generic drugs will get a significant increase in space, intermediates manufacturers will still enjoy the explosive growth of demand in the short term, and the long-term extension to the downstream of the industry chain by virtue of its technical advantages, the profitability of enterprises will further improve. And general-purpose especially dye intermediates, benefit from environmental protection requirements to suppress the capacity of small and medium-sized enterprises, industry supply contraction, the leading enterprises will enjoy the profit growth brought by price improvement.

3.1 Pesticide, pharmaceutical intermediates demand for stable growth, with room for growth

The demand for pesticide intermediates is relatively stable, and the downstream demand is growing slowly. China's patented pesticide custom intermediates are mainly export-oriented, corresponding to the downstream of the global pesticide market. Pesticide is a rigid demand, the tightening of the arable land area, the change of agricultural farming mode, the increase of purchasing power and the improvement of living standard will significantly increase the market demand for agriculture. It is expected that the global pesticide industry will show a slow growth trend in the future, which will drive the steady growth of China's proprietary pesticide custom intermediates industry.

Figure 10: Global Crop Protection Market Size Growth Trend

Figure 11: Global Pharmaceutical Market Size Growth and Forecast

3.2 Under the background of patent cliff, there are opportunities for CDMO mode and industry chain extension

The downstream pesticide and pharmaceutical industries are both facing the "patent cliff", which is a challenge and an opportunity. In the next few years, dozens of important patented pesticides will be transformed into generic drugs. In recent decades, the development costs of patented pesticides have increased rapidly, while a large number of important pesticide patents have expired, internationally known as the "patent cliff". According to "Agrow's New Generics 2018," between 2018 and 2022, a total of According to Agrow's New Generics 2018, 30 pesticides will have expired patents on compounds that will be converted from patented pesticides to generic pesticides between 2018 and 2022.

Figure 12: Global heavyweight pesticide patents expire

The share of the generic pesticide market has been increasing. The development of generic pesticides, especially the pesticide varieties whose patents are about to expire, has been a hot spot for the development of the pesticide industry. Therefore, the world's pesticide giants have gradually begun to shift their focus to the production of generic pesticides, and their share in the global pesticide market has been increasing year by year. According to China Pesticide Network, there are 28 pesticide compound patents expiring during 2015-2020, among which 13 products have a compound annual growth rate of more than 10.0% during the patent period of 2010-2015, much higher than the average growth rate of 4.4% in the pesticide industry.

As with pesticides, a $194 billion market for patented drugs is expected to face patent expiration between 2017 and 2022, the second patent cliff peak since 2012, according to Evaluate.

Figure 13: Generic drug sales opportunities due to patent expiration

Intermediates upgrade to CDMO mode and enjoy the profit improvement of product release. As custom intermediates, their downstream commodities are patented pesticides/pharmaceuticals, under the current patent cliff background, the orders of downstream single customers will certainly be greatly affected, however, if custom intermediates can deeply bind the production of products with their years of production experience and technical advantages, the companies will benefit from the rapid growth of downstream demand. The product release opportunity brought by deep binding still has considerable profit space.

Industry chain extension and integrated layout will effectively enhance the competitiveness of enterprises. Because of different positions in the industry chain, sales margins vary greatly and profits are not comparable. The same is true for intermediate enterprises.

3.3 Industry de-capacity effect is remarkable, leading dyestuff intermediates enterprises enjoy the profit space of price rebound

Global demand for dyestuffs continues to grow, and intermediates benefit simultaneously. Although in recent years, China's printing and dyeing industry has continued to be in the doldrums, and the growth rate of dyestuff production has declined significantly, which has failed to effectively support the development of intermediates industry, however, from a global perspective, the demand for dyestuffs will show continuous growth in the future, which forms a certain support for the intermediates industry. According to MRFR, the compound growth rate of 8.13% will be maintained from 2016 to 2023, which will have a long-term impact on the export of intermediates. In the long run, it will have a pulling effect on the export of the dye intermediates industry.

Under the high pressure of environmental protection, the price of dyestuff intermediates rose rapidly, pushing up the profit level of industry leaders. Under the current background of high pressure of environmental protection, a large number of enterprises have shut down production and the industry has a significant effect of de-capacity due to the large environmental pollution produced by dyestuff intermediates in the production process, leading to a rapid rise in product prices. For the leading dyestuff intermediates manufacturer, which attaches importance to environmental protection and has not shut down production, the company's operating income and gross margin profit have increased significantly.

4. Investment recommendations

Under the background of the continuation of industrial transfer trend, continuous growth of downstream industries and tightening of environmental protection in China, the industry will leave the period of rough and rapid development and enter a new stage of leading prosperity. The leading intermediate companies have strong R&D strength and environmental governance capabilities, and through strong R&D technology advantages to CDMO mode development, industrial chain extension, broaden product lines and enhance profitability. Based on the above logic, we recommend the leading fine chemical intermediates with perfect environmental protection system, strong R&D strength and industrial chain extension opportunities.

5. Risk tips

The progress of industrial transfer of overseas intermediate industry is lower than expected. Downstream pesticide, pharmaceutical and dye market boom is lower than expected. China's environmental protection control is lower than expected, and the effectiveness of R&D and industrial chain extension of intermediate enterprises is lower than expected.