The Amino Acid Industry Ushers in a New Round of Boom

The amino acid industry is expected to usher in a new round of boom due to cost support on the raw material side and strong downstream demand. Corn is the raw material for lysine and threonine in amino acids, and China's corn destocking ended in 2020. In 2020, China's corn stocks was closed and the new production was affected by the typhoon weather in the northeast, and the corn price rose rapidly to a record high, which supported the cost side. Lysine and threonine are mainly supplied to the downstream farming feed sector, and downstream demand is expected to continue to improve driven by pig replenishment. In 2020, the production capacity of lysine and threonine dropped year-on-year, after the industry generally lost money to clear the inefficient capacity. But the output rises year-on-year and the production pattern is good.

1. Raw material corn prices rose rapidly to a new six-year high

Corn prices have risen rapidly to a new record high. 2020 saw the global spread of the new crown epidemic and food security was once again thrust into the limelight, coinciding with the end of China's corn destocking. In the meantime, the new season of corn in northeast China in 2020 was hit by a triple whammy of typhoons, which led to a large area of fallen corn. The market price of corn rose rapidly and hit a six-year high, up by 49.3%.

The average price of corn rose 15.4% year-on-year in 2020, with a monthly increase of 47.2%; the price of soybean meal was strong, with the annual average price rising slightly by 4.4%. There is still a gap between supply and demand in the corn market, and prices are expected to remain high. Corn and soybean meal are the raw material of amino acid, supported by the rising cost, lysine, threonine and other downstream deep processing products prices are expected to remain high.

2. Demand on the breeding side continues to recover

China's hog inventory has recovered positively. At the end of the third quarter of 2020, there were 370.39 million live pigs in stock, up by 20.7% year-on-year, turning from negative to positive. Among them, there were 38.22 million breeding sows in stock, up by 28.0% year-on-year.

Feed demand on the breeding side is increasing. According to the Feed Industry Association, pig feed production has been increasing year-on-year since June 2020. In October 2020, pig feeding production reached 9.34 million tons, up 64.3% year-on-year.

3. Supply and demand pattern of amino acid industry is improving

3.1 Prices enter the fast rising channel, and the industry starts to turn into profitability

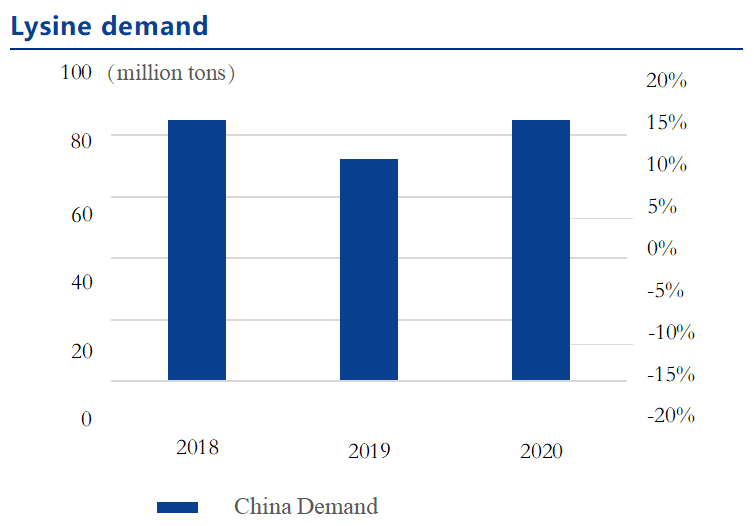

Lysine prices have risen to a high level in the past three years, and the industry will start to turn losses into profits by the end of 2020. According to BoA, the average price of 98.5% lysine in 2020 is 7.45 yuan/kg, up 6.21% year-on-year.

Lysine industry profits declined year-over-year in 2020, with longer losses, but lysine industry profits were finally moving toward profitability from November, supported by costs.

Threonine prices rose sharply at the end of 2020, reaching a near three-year high.

3.2 Inefficient capacity is cleared, production is steadily increasing, and the supply side pattern is better

Global lysine capacity declined in 2020, mainly due to the shutdown or withdrawal of inefficient capacity in China and the alternation of old and new capacity. China's threonine industry was largely cleared of inefficient capacity due to deep losses, and the year-on-year start-up rate increased significantly in 2020. Threonine industry started remain stable, with capacity utilization increasing in 2020. Lysine production is increasing year on year.

3.3. Strong overseas demand, export unit price increase

China's lysine exports continue to increase. Threonine exports grew significantly in 2020, and the overall market supply and demand was balanced. Tight freight capacity, lysine and threonine export prices rose year-on-year

4. Risk tips

Product price fluctuations, highraw material prices and downstream demand are not as expected.